Personal banking solutions

Your personal finances are just that: personal. We take special care to protect your information and make sure you are making the right decisions. Discover what Frost has to offer for your personal banking, investment and insurance needs.

Explore products and services for every stage of life

We provide 24/7 support over the phone or through live chat.

Building better financial health

Barriers to financial belonging are barriers to financial health. We fielded this research and put in the work every day to make sure our costumers feel like they belong.

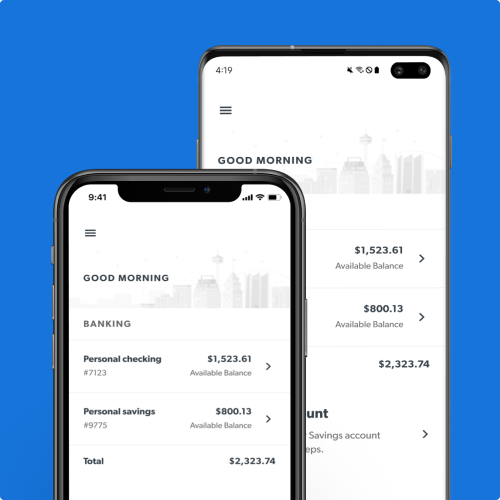

Bank anytime, anywhere with the mobile app

Our top-rated banking app offers powerful features you’ll love to use, such as the ability to send money to friends, see all your accounts in one place and securely log in with biometric technology.

See what our customers say about us

When you have an account with Frost, you have a relationship with Frost. We’ll answer the phone when you call 24/7, right here in Texas. Don’t take our word for it. Here’s what our customers have to say about us.