Frost Personal Account

The essential account to feel confident about your money.

- Direct deposits*, mobile deposits, debit card credits** or Zelle credits totaling $100 or more OR

- Keep a minimum daily balance of $1,000 OR

- $5,000 combined average daily balances*** in personal deposit accounts, including checking, savings, money market, CDs and IRAs OR

- An owner on the account is under 25

OR

*Direct deposits may include paychecks, pensions, Social Security or other monthly deposits through the ACH system.

**Debit Card credits include non-Zelle P2P transactions such as Venmo, Cash App, PayPal, and Apple Cash.

***The average daily balance is calculated by adding the principal for each day of the period and dividing that figure by the number of days in the period.

The benefits of banking with Frost begin here

- 24/7 customer service

- Fee-free overdrafts up to $100*

- Deposits made by 9 PM CST are generally available the next business day

- Mobile app designed with you in mind

- 1,700+ ATMs including H-E-B and Circle K locations statewide, plus CVS and Walgreens stores in North Texas

*For Frost Personal and Frost Plus accounts, overdrafts created by check, in person or ATM withdrawal or other electronic means will not be charged a $35 overdraft fee if you overdraw your account $100 or less under our standard overdraft practices.

This is a discretionary service and the bank reserves the right not to pay items against insufficient funds, such as when your account is not in good standing or you are not making regular deposits or you have too many overdrafts. You will be responsible for making a deposit as soon as possible to bring your account back to a positive balance.

Our customers mean everything to us

For the 16thconsecutive year, Frost Bank ranked #1 for Consumer Banking Customer Satisfaction in Texas, according to the J.D. Power 2025 U.S. Retail Banking Satisfaction Study℠.

For J.D. Power 2025 award information, visit jdpower.com/business/awards

Get your hands on your direct deposits up to two days earlier

We're making direct deposits available up to two days earlier in any Frost personal checking account. So whether you're paying bills or building savings, you're worrying less and doing more with what's yours.

Settle up or get paid. Instantly.

If you’ve got their email address or mobile number, you can send, request or receive money from friends or family with Zelle®. No matter who they bank with.**

**Must hold a U.S. bank account and email or mobile number.

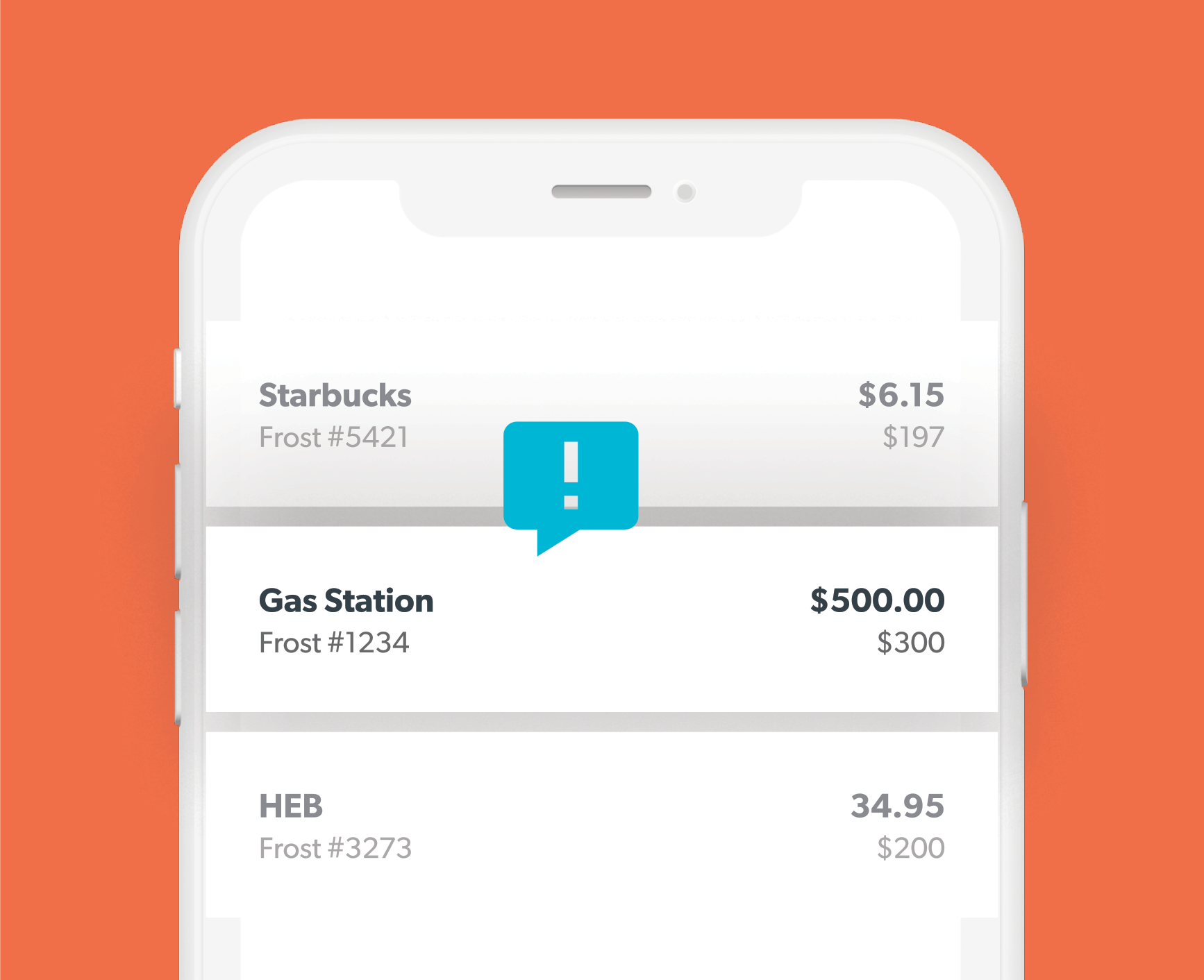

Stay ahead of fraud

With customizable Debit Card Alerts, you’ll hear from us if a transaction on your account looks suspicious.

Interest Information

| Interest Rate and APY | If your daily balance is $5,000 or more, the interest rate paid on the entire collected balance in your account will be 0.02%, with an annual percentage yield of 0.02%. The interest rate and annual percentage yield may change at any time at our discretion. Fees could reduce earnings on the account. Rates effective 11/21/2025. |

|---|---|

| How the Interest Rate is Calculated | We use the daily balance method to calculate the interest on your account. This method applies a daily periodic rate to the collected balance in the account each day. |

| How Interest is Compounded | Interest will be compounded and credited to the account monthly. If you close your account before the interest is credited, you will receive the accrued interest. |

| When Interest Begins to Accrue | Interest begins to accrue no later than the business day we receive credit for the deposit of non-cash items (for example, checks). |

ATM Fees

| Frost ATMs | $0 |

|---|---|

| Pulse Point-of-Sale Terminals | $0 |

| H-E-B, Corner Store, and Circle K Locations in Texas | $0 |

| Non-Frost ATMs | $2 for any Transfers or Withdrawals while using a non-Frost ATM, plus any fees the ATM owner charges. |

| Notice regarding ATM fee by others - If you use an automated teller machine that is not operated by us, you may be charged a fee by the operator of the machine and/or an automated transfer network and you may be charged a fee for a balance inquiry even if you do not complete a funds transfer | |

Overdraft Fees

| Overdrafts created by check, in-person withdrawal, ATM withdrawal or other electronic means |

$35 for each item we pay that overdraws your account by more than $100, up to a maximum fee of $105 per day. We will not charge you an overdraft fee if:

|

|---|---|

Overdraft Protection Transfer, each advance from:

|

$0 $0 (interest will apply on the outstanding balance) |

Miscellaneous Fees

| Check certification | $10 |

|---|---|

| Check order | Fee varies |

| Cashier’s check | $5 per item |

| Money order | $5 per item |

| Return item | $0 per item |

| Stop payment | $30 per item |

| Outgoing wire transfer | Fee varies |

| Incoming wire transfer | $15 |

| Domestic collection item | $20 per item |

| Foreign collection item | $40 per item |

| Hold mail at financial center for pick-up | $10 per month |

Bank where you matter

At our core, we’re just people helping people. We’re passionate about supporting your financial goals, keeping your money accessible and offering help when you need it.

There are no surprises charges, they’re always there to help people. I’ve always been very happy with Frost

This sounds so silly, but i love my bank. I love the friendliness, I love the customer service, I love how they treat you the same regardless of if you have $10 or $10 million.

I love the ability to contact customer service 24/7 and now many of the issues I have are fixable on my app.

When you have an account with Frost, you have a relationship with Frost. We’ll answer the phone when you call 24/7, right here in Texas. Don’t take our word for it. Here’s what our customers have to say about us.