Peace of Mind

One Piece at a Time

Peace of Mind One Piece at a Time

We put these security tools in your hands.

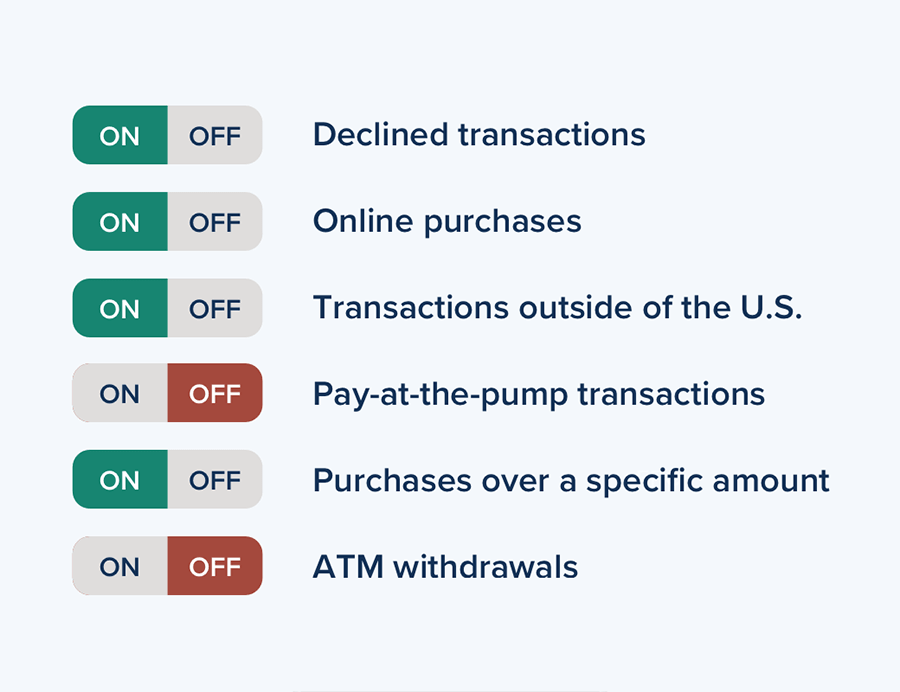

Debit Card Alerts

For Personal and Business

Receive real-time, custom alerts sent straight to your phone to help stop fraud in its tracks.

See how Debit Card Alerts work

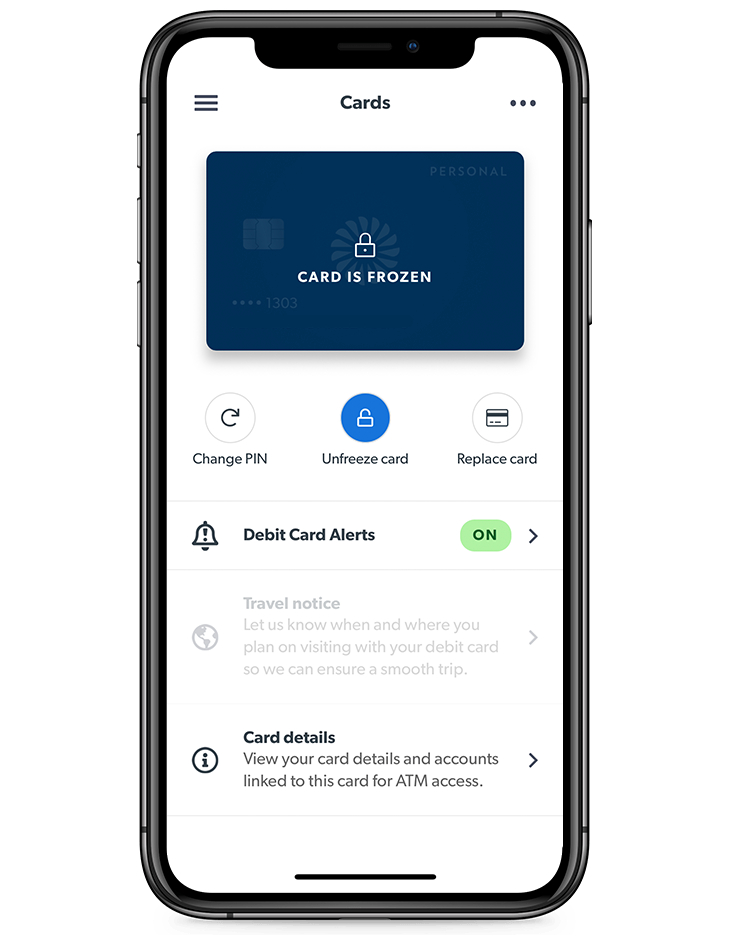

Freeze your card

For Personal and Business

If your debit card is lost or stolen, you can freeze it from our app or online banking to help prevent unwanted purchases. And, if you find it, you can unfreeze it.

Biometric Login

For Personal and Business

A quick glance or the touch of a finger is all it takes to log in to the Frost App. This feature uses the latest biometric technology to create a more secure, more convenient way to access all your banking needs on the go.

Available on iOS and Android.

Travel Notices

For Personal and Business

Let us know you’re leaving the U.S. straight from our app. You simply set your destination and departure and return dates. Then we’ll know it’s you using your debit card.

And here are some other steps we take

Cards with Chip Technology

Our debit cards feature chip technology that’s nearly impossible to counterfeit.

Secure Login

Security profiles and other safeguards ensure secure online and mobile banking.

Fraud Response

Rest assured we monitor systems around the clock and will protect you if there’s a problem.

Ready to open a personal checking account online?

We'll take care of everything to make it easy to open your checking account with Frost. Have these things handy.

Open Checking Accounts-

Social Security Number

We’re required by federal law to collect your SSN. -

Goverment-Issued Photo ID

This can be a driver’s license, state ID or U.S. military ID. -

Minimum Opening Deposit

You’ll need to make an initial deposit of $25 or more.